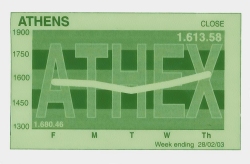

| Athens Stock Market Hits Five-Year Low Investors reeling at losses, but ELPE bucks trend with 121 percent profit

***

On February 27 Greek equities eased 0.23 percent as the market chewed on more 2002 earnings, although index heavyweight OTE Telecom took heavy losses after its net profit fell short of market expectations. .

Hellenic Petroleum bucked the trend to gain 3.38 percent to 4.90 euros, with a 121% rise in pre-tax profits. The company said it planned to propose a 25 percent increase in its dividend per share for 2002 to 0.15 euros. Total turnover was low, at 65.4 million euros with 19.2 million shares changing hands. Losers beat winners 168 to 122 with 64 shares unchanged on 354 traded. On February 25 Greek equities fell to five year lows under the weight of sliding European bourses while banks tumbled again. The bank sector as a whole retreated 3.98 percent while the Athens bourse benchmark general index fell 2.42 percent to 1,623.343 points, it lowest level since March 1998. Total turnover was a 96.96 million euros with 26.3 million shares changing hands. Loses beat winners 320 to 20 with 22 shares unchanged on 362 traded. On February 24 Greek equities lost one percent, with financials continuing to bleed after some of the sector’s largest players disappointed with their 2002 dividends. Heavyweight banks shed 1.72 percent while the Athens bourse benchmark general index ended off 1.01 percent at 1,663.52 points Mobile operator CosmOTE fell 0.83 percent to 9.52 euros despite announcing healthy 2002 earnings. Hyatt Regency gained 1.18 percent. Turnover was 52.01 million euros with 13.3 million shares changing hands. Losers beat winners 261 to 46 with 44 shares unchanged on 351 traded. The Athens bourse benchmark general index ended 0.74 percent lower at 1,680.46 points. Turnover was 57.24 million euros, substantially above recent 52-week lows, with 16.3 million shares changing hands. Losers outnumbered winners by 229 to 73 with 51 shares unchanged on 353 traded. |

|