No one likes sharing control

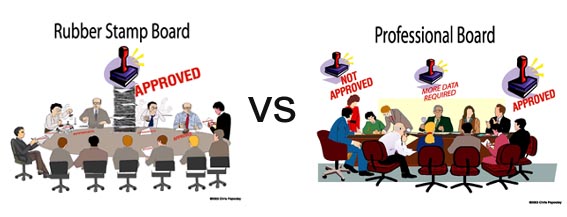

Owners and top management of corporations generally do not like to share control. Institutionalization of a business, however, means sharing control by establishing an effective, independent board of directors, not a "rubber-stamp" board. By sharing control of a business, there is a better opportunity for transparency, real oversight and accountability. "Rubber-stamp" boards notoriously contribute to corruption and scandals in corporations and represent the antithesis of an ideal board of directors. No business, small or large, public, private or non-profit, can be considered truly institutionalized until it has an independent board of directors comprised of men and women who are respected, competent, enthusiastic, diligent, and hard-working. And the ideal business climate for this board is one where disagreement is accepted as a virtue, not a vice.

What values and qualifications should directors possess?

At the top of the list for qualifications of directors are commitment, dedication, integrity and experience. Good directors are good listeners. Good directors devote adequate time to ensure that they are prepared for meetings and that they know enough about the corporation's business to perform their duties seriously and intelligently. The best candidates for the board are deeply concerned about all stakeholders, as well as their responsibility to help enhance the interests of stockholders in an ethical manner.

What should directors do?

The key duty of each director is oversight responsibility. The business of the corporation is managed by its executive officers and senior management under the direction of the board. The board, in turn, has a fiduciary duty and obligation to oversee management efforts to enhance the interests of stockholders. In that capacity, a director serves as monitor, councilor, supporter and critic.

The board's principal oversight responsibilities include: selection, evaluation, and compensation for the CEO and senior executives; review and approval of management's mission, strategy, business and financial plans, commitments of significant corporate resources and material transactions outside of the ordinary course of business. Together with the CEO, the board works to set the tone for the business operation of the corporation, setting standards and implementing and enforcing ethical values.

It falls within the duties of the board to ensure the corporation's compliance with all local and international laws and regulations, the adoption and implementation of a code of conduct and specific ethical guidelines, the promotion and monitoring of transparency and full disclosure, accountability, and the independent make-up of the board itself. Membership of the board should include at least a majority of independent, unpaid directors, and in some cases, an employee. This board must also oversee its own operation, establish a nominating and governance committee that ensures the recruitment and education of informed directors, that avoids conflicts of interest, and that implements self-assessment programs to evaluate the performance of individuals and of the board as a whole. Excellent corporations regularly challenge themselves in the performance of their oversight and accountability functions.

In short, corporations must create and foster a culture in which the interest of the directors is aligned with that of the stockholders. This is the sustained culture in which good corporate governance prevails and all significant corporate decisions and actions are tested against the pivotal question: How does this benefit the stockholders and the stakeholders? The successful road for any business that wants to sustain itself as a CSR (corporate socially responsible) entity requires institutionalization, a sharing of control with an independent, enthusiastic, knowledgeable board of directors. In an institutionalized corporation where governance and oversight are shared, disagreement is a virtue, not a vice.

For more information about Mr. Papoutsy, his free international schedule, or to read other articles of his on corporate social responsibility or business ethics, visit the Business Arena and Ethics sections of Hellenic Communication Service (HCS) website, or the web pages of the Christos and Mary Papoutsy Distinguished Chair in Ethics at Southern New Hampshire University. Mr. Papoutsy welcomes comments and questions and can be reached via email at Papcoholding@papcoholdings.org.

2000 © Hellenic Communication Service, L.L.C. All Rights Reserved.

http://www.HellenicComServe.com