|

||

|

Greeks Can't Make Ends Meet Athens News |

||

|

EU and central bank surveys show that local consumption patterns reflect a widening gulf between disposable household income and the capacity to satisfy basic needs

By Dimitris Yannopoulos

|

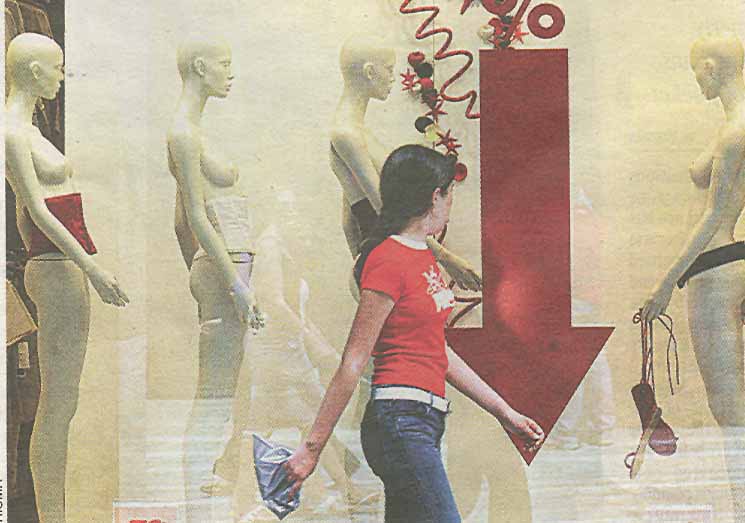

Greek consumers face a limited range of choices as they try to make ends meet with disposable incomes lower than those of their European counterparts |

|

|

Eurostat defines material deprivation as "the enforced lack of a combination of items depicting material living conditions, such as housing conditions, possession of durables and capacity to afford basic requirements". More than half (52 percent) of Greek families are unable to pay for a week's holiday away from home every year, according to the European Commission's statistical service. One in five (19 percent) of Greeks cannot afford to adequately heat their homes, Eurostat said. Of the 15 'older' EU member countries, only Portugal ranked worse in the corresponding material deprivation indices, with 70 percent of households facing the same difficulties. The difficulty in making ends meet becomes even more pronounced if the cost of household utilities is taken into account. Greek electricity rates are among the lowest in Europe, at just 6.70 euros per kwh, having risen only 4.7 percent in the last four years. Greek heating costs are also among the lowest - 329.30 euros per 1,000 litres, higher only than Luxembourg's 300 euros and the UK's 273.80 euros. Regional dimension Greece comprises 4 million households, with an average of 2.82 members. Their purchasing power is the lowest among the EU -15 members and their total consumption expenses as part of gross domestic product are second-highest among the EU's current 25 members, at 67.2 percent, after Cyprus' 67.7 percent. Each household in Greece spends 16,147 euros per year; against an EU average of 25,114 euros. The biggest spenders are households with two adults and two children. Material deprivation also has it regional dimension. Monthly household spending in the regions of eastern Macedonia and Thrace was around 172 euros lower compared to average household spending in Greece in the period 2004/05, the Bank of Greece said in its regional economic bulletin on January 13. . The average monthly spending by Greeks living in eastern Macedonia and Thrace did not exceed 1,628 euros, against an average of 1,800 euros of the country, 1829 euros in central Macedonia and 1,778 euros in western Macedonia). Monthly spending on, food was 280.85 euros in eastern Macedonia and Thrace; compared to a Greek average 0006.44 euros. The main expenses are for housing (rent, maintenance, operating costs) which accounts for 21.9 percent of all expenditures, followed by food at 16.6 percent. As regards the consumption of durable goods, 12 percent of the Greeks Cannot afford to buy a car (compared to 17 percent in Portugal and less than 9 percent in northern and central Europe). Prices of durable household equipment rose 4.6 percent, against an average of 9.3 percent in the 25 members. Unhappy homeowners At the same time, 22 percent of Greeks live in homes that need repairs which they cannot afford. Only Portugal fared worse in this category with the corresponding figure standing at 37 percent. Consequently, Greeks are among the unhappiest with their residential conditions, with 32.2 percent expressing dissatisfaction against an EU-15 average of 13.6 percent. The most important adverse factors cited are environmental noise pollution (22.6 percent), inadequate heating (20.3.percent) and limited space (19.3 percent). However, the Greeks with the Spaniards and the Irish top the list of Europeans in the old EU-15 members who live in their own homes, Eurostat found. In Spain the rate is 84.8 percent, Greece follows closely behind with 84.6 percent and Ireland is third with 81.9 percent. In contrast, most Germans prefer to rent, as only 43.8 percent live in their own homes - the lowest rate in the EU. Greek house prices have risen 36.9 percent since 2000, the third-highest rate after Spain's 62.5 percent and the UK's 46.8 percent. Rents have risen 19.2 percent in the last four years, against an EU-25 average of 8.7 percent. According to Eurostat, only 8 percent of Greeks have taken out mortgage loans, compared to19 percent in the old EU-15 members as a whole. About 1 percent have two housing loans. In contrast, 44 percent of Swedes and Danes have taken out mortgages, with the Netherlands and Luxembourg following closely behind at 40 percent and 39 percent respectively. Greeks also appear as the most reluctant users of the Internet for banking services and shopping among the old EU-15 members. The biggest shift by far in Greeks' expenses has been in mobile telephone services, rising by 21.4 percent in the last five years. Telecommunications was likely the only sector where price drops of 23.1 percent were recorded, the steepest decline in the EU after Cyprus. Nevertheless, Internet prices in Greece are by far the highest in Europe, with broadband market penetration around 1.1 percent compared to an EU-25 average of 6.5 percent. |

||

HCS readers can view other excellent articles by the Athens News writers and staff in many sections of our extensive, permanent archives, especially our News & Issues, Travel in Greece, Business, and Food, Recipes & Garden sections at the URL http://www.helleniccomserve.com./contents.html

All articles of Athens News appearing on HCS have been reprinted with permission. |

||

|

||

|

|

||

|

2000 © Hellenic Communication Service, L.L.C. All Rights Reserved. http://www.HellenicComServe.com |

||